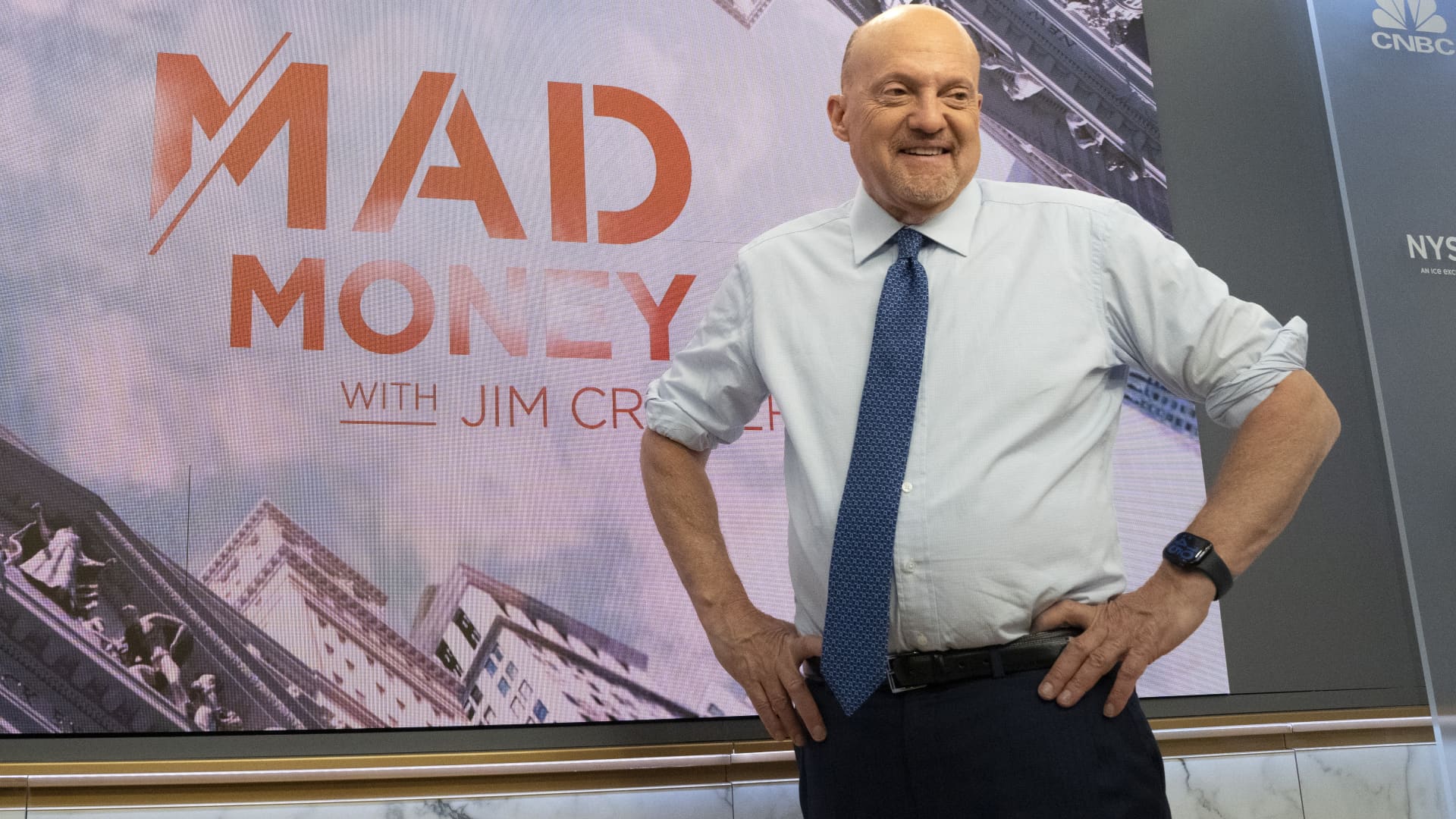

CNBC’s Jim Cramer examined Tuesday’s market action, saying the rally fueled by the victory of President-elect Donald Trump took a breather as Wall Street weighs what broad tax cuts could mean for the bond market.

“If you believe we’re about to get big tax cuts, remember that somebody eventually has to pay for the missing tax receipts — as boring as that is — even if that means the government borrows a lot more money, causing bond yields to spike,” he said.

The major indexes declined Tuesday with the Dow Jones Industrial Average closing down 0.86%, while the S&P 500 shed 0.29% and Nasdaq Composite slipped 0.09%. Cramer called the day’s moves a “sobering reaction to the potential unfunded tax cuts from the bond market,” as both the 10-year and 2-year Treasury yields surged more than 4%. The bond market and the stock market usually have a negative correlation, with investors coming in and out of each depending on yields.

Trump campaigned on the promise of tax cuts across a wide swath of sectors. Many on Wall Street expect these cuts will come in aggregate, but remain unsure of the specifics, Cramer noted. He suggested that if Trump’s new tax plans are similar to those he implemented in 2016, wealthy people will stand to benefit the most — which may not help the economy but will usually help the market see gains.

After investors spent days reveling at the thought of how tax cuts could boost earnings, they may now be anticipating how the U.S. will be forced to make up for those lost contributions — usually by selling bonds, Cramer added. He rebuked a few theories about other ways the government could recover these funds, such as increased tariffs or some sort of plan to drastically trim the deficit thought up by a newly-empowered Tesla CEO Elon Musk, a close ally of Trump.

“We can only hope the stock market goes back to ignoring long-term interest rates, or that those rates come back down in response to some benign inflation numbers,” Cramer said. “Otherwise, you got to expect more days like today.”